13th Month Pay For Government Employees 2020 Guidelines

SEPARATION PAY Articles 298- 299. NO EXEMPTION OR DEFERMENT No request or application for exemption from payment of 1 3th month pay or for.

How To Compute 13th Month Pay In The Philippines An Ultimate Guide

Thirteenth-Month Pay of Female Employee who is on Maternity Leave 40 J.

13th month pay for government employees 2020 guidelines. WCAG 20 is also an international standard ISO 40500. Thirteenth-Month Pay for Certain Types of Employees 39 H. The computation of the 13th month pay is the total basic salary earned during the year divided by 12 months equals to proportionate 13th month pay.

Executive Order No. The 13th month pay shall not be less than 112 of the total basic salary earned by an employee within a calendar year. 13th Month 2020 Guidelines To Resigned Or Terminated Employees As for the government employees palace ensured that will be given this years benefit and based on Salary Standardization Law the yearend bonus of the government workers will be released by the month.

3 b specifically excludes government employees. 851 requires private sector companies to pay their rank-and-file employees 13th month pay on or before Dec. 13TH MONTH PAY Here are some of the things you might want to know about the 13th month pay for government employees and release date.

The thirteenth-month pay shall not be less than one-twelfth 112 of the total basic salary earned by an employee in a calendar year. Thirteenth-Month Pay of Resigned or Separated Employee 40 I. Pay the workers their 13th month pay on or before December 24 said Bello during a Laging Handa virtual press briefing.

WCAG 20 contains 12 guidelines organized under 4 principles. Ngayon meron na tayong 14th month pay. However under Sec8 of Republic Act No.

Non-inclusion in Regular Wage 41 K. The basic salary of an employee for the purpose of computing the thirteenth-month pay shall include all remunerations or earnings paid by. The 13th month pay and other benefits including productivity incentives and Christmas bonuses are exempted from tax if they do not exceed P90000 according to Republic Act 10963 or the Tax Reform for Acceleration and Inclusion TRAIN law.

For people of the working sector the 13th month benefit is something that they are looking forward every December. Coverage from Income Tax of the 13th Month Pay 41 14. Government employees will receive a 14th month-pay and a P5000 cash gift next week Budget Secretary Benjamin Diokno said Thursday.

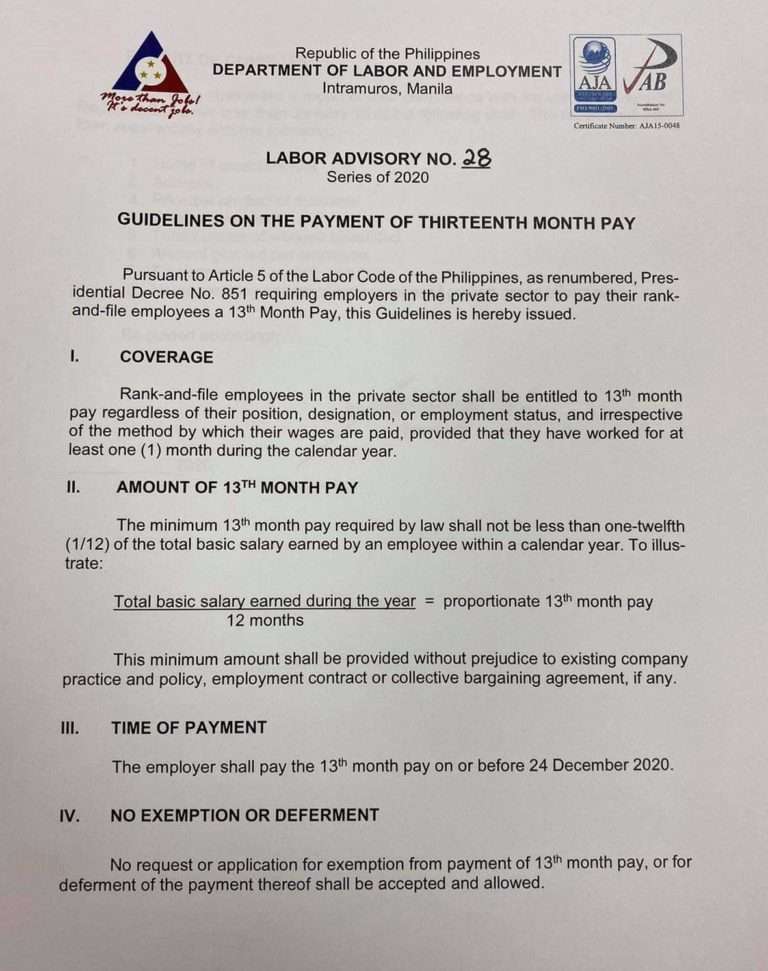

The minimum 13th month pay required by. 11466 or the Salary Standardization Law of 2019 1 government employees are entitled to the following. DOLE Advisory Guidelines on the Payment of 13th Month Pay 2020 PDF Copy of the DOLE Guidelines on 13th Month Pay.

Bello explained that the minimum 13th month pay required by law shall not be less than one-twelfth of the total basic salary earned by an employee within a calendar year. All national government employees even if they are working from home assignment are receiving their full salaries but there is no directive from the President yet to release their 13th month pay earlier than scheduled according to Department of Budget and Management DBM. 201 signed by President Aquino in February mandates the grant of a midyear bonus or 14th-month pay equivalent to one months salary to government employees.

This will be formalized in a DOLE order to be issued on. This an additional pay for them which is equivalent to their one month salary. Perceivable Operable Understandable and Robust POUR for short.

This certifies it as a stable and referenceable technical standard. Rank-and-file employees in the private sector shall be entitled to 13th month pay regardless of their. NO EXEMPTION OR DEFERMENT No request or application for exemption from payment of 1 month pay or for.

Amount of the 13th Month Pay. Last Updated on 04272020 by FilipiKnow Government employees are not entitled to the 13th-month pay contemplated under PD. Such employees are entitled to the benefit regardless of their designation or employment status and irrespective of the method by which their.

The employer shall pay the 13th month pay on or before 24 December 2020. There are testable success criteria for each guideline. The employer shall pay the 13th month pay on or before 24 December 2020.

With the removal of the salary ceiling of P100000 all rank and file employees are now entitled to a 13th month pay regardless of the amount of basic salary that they receive in a month if their employers are not otherwise exempted from the application of PD. Presidential Decree No.

Here S What You Need To Know About 13th Month Pay In The Philippines Jobstreet Philippines

13th Month Pay Computation Dole Labor Advisory

13th Month Pay 2020 Guidelines To Resigned Or Terminated Employees

Everything You Need To Know About 13th Month Pay Sunstar

13th Month Pay Computation Dole Labor Advisory

How To Compute Your 13th Month Pay 2020 Jobs360

Dole Guidelines For 13th Month Pay In Private Sectors

13th Month Pay An Employer S Guide To Monetary Benefits

Mid Year Bonus 2020 Everything You Need To Know Including Pnp Mups

Dole Advisory Guidelines On The Payment Of 13th Month Pay 2020

13th Month Pay For Government Employees Release Date

New Dole Advisory On 13th Month Pay Requirements For Employers In The Philippines In 2020 Cloudcfo

Sample Computation Of 13th Month Pay For Year 2020 Lvs Rich Publishing

Dole Guidelines For 13th Month Pay In Private Sectors

How To Compute Your 13th Month Pay 2020 Jobs360

13th Month Pay In The Philippines Computation And Guide

Dole Directs Private Companies To Give 13th Month Pay By December 24 Life Of Maharlika

Government Workers Pnp Bfp Bjmp Etc To Get Year End Bonus And Cash Gift For 2020 Life Of Maharlika

Post a Comment for "13th Month Pay For Government Employees 2020 Guidelines"