Monthly Salary Calculator India From Ctc

The bonus is deducted. See how we can help improve your knowledge of Math Physics Tax Engineering and more.

Basic Salary Calculation Formula In Excel Download Excel Sheet

CTC is never equal to the amount of take home salary.

Monthly salary calculator india from ctc. Here is the simple take home salary calculator which you can download in Excel format and know your estimated in hand salary with. Last drawn salary basic salary plus dearness allowance X number of completed years of service X 1526. Which Companies use this Salary Calculator.

Our Take Home Salary Calculator India 2020-21 tool helps you quickly calculate your estimated monthly take home salary from your CTC. Scroll down you will view the Salary Structure calculation based on details provided by you. To calculate the take-home salary you must enter the Cost To Company CTC and the bonus if any as a fixed amount or a percentage of the CTC.

The CTC Cost to Company of an employee includes the PF contribution of employer and gratuity amount and any other expenses that the company is spending on the employee. 2 Your Cash in Hand per month is calculated after considering tax deducted at source from your Salary Income. Go to Calculator Stack enter your CTC and basic monthly pay they will show your whole salary breakup along with the take home salary.

House Rent Allowance HRA Usually 30 of your basic salary Employers contribution to your PF 12 of your basic salary Food Coupons Like Sodexo Card etc Usually INR 1250- per month. AM22Techs Indian salary calculator is easy to use if you know your salary package. If you are looking to automate you Organisations CTC salary structure in excel then you can download PayHRs Latest Excel CTC Salary Calculator in which you can customize your cost to company as per your company policy.

Enter your Yearly Cost to CompanyCTC and monthly Basic Pay and click Calculate Take Home Salary Calculator India has been updated for the financial year 2020-2021 Take home salary calculator is also referred in india as in hand salary calculater. Can you list them. Take home salary of an employee in India is CTC Gross salary Deductions.

Enter the Basic Salary HRA and other income as listed on your CTC. So to know about the take home salary calculator India and the way it works lets know about the basic salary gross salary differences between basic salary and gross salary Cost to Company net salary. The Salary Calculator is designed to input only the Fixed Components of your CTC.

Annual Salary - 179400 monthly salary 12 months 1495012 Employer contri- 17880 PF ESI Annual CTC 197280- Rest it all depends on company to company the components the allowances perks etc. The employer gives you a bonus of Rs50000 for the financial year. CTC Direct Benefits Indirect Benefits Savings Contributions Direct Benefits refer to the amount paid to the employee monthly by the employer which forms part of hisher take-home or net salary and is subject to government taxes.

Do not worry about the other missing components in the calculator they are your variable components which doesnt come to your hand monthly. Difference between Basic Gross and Net Salary and CTC. To access PayHR Online CTC Calculator click here.

How does salary calculators work. 16th June 2011 From India Delhi. Gross salary CTC - PF - Gratuity.

Basic Salary It is usually 45 to 50 of your CTC. The basic salary is arrived at. Enter annual CTC amounts and then select the compliance settings as per your establishment applicability 2.

The In-hand Salary also known as Take-home or Net Salary can be calculated with the help of CTC as follows. CTC is inclusive of monthly components such as basic pay various allowances reimbursements and annual components like gratuity annual variable pay annual bonus etc. 3 Your Cash in Hand per month does not consider the amount spent on tax saving investmentinterest on home loan and profession tax deducted from your Salary.

The calculator will find the total yearly income tax and then show you the monthly deductions and monthly net income that should be credited to your bank account. For example your Cost To Company CTC is Rs10 lakh. The gratuity amount depends upon the tenure of service and last drawn salary.

How to calculate the take home salary. Ive personally tested on HCL CSC KONE Flextronics and iNautix salary payslips all my colleagues are using it. PayHR Online CTC salary calculator helps HR and Payroll Accountants to calculate how much Net Salary to be paid to employees based on agreed CTC.

One of a suite of free online calculators provided by the team at iCalculator. How To Calculate In Hand Salary From CTC. India Monthly salary calculator enter your Monthly salary and press enter to calculate your salary after tax simple.

The basic salary is the fixed or particular amount paid to employees for the work done by them. It now also provides option to calculate your take home salary choosing either Old or New Tax Slabs to calculate your estimated tax liability. Gross Salary CTC EPF Gratuity Calculate Taxable Income.

The India income tax calculator for 202122 with Monthly Tax Calculations. Annual CTC or Cost To Company in the total amount that a company spends on an employee. Your total gross salary is Rs1000000 Rs50000 Rs950000.

It is calculated according to this formula. Taxable Income Income Gross Salary Other Income Deductions. We start with calculating the Gross salary as follows.

How exactly can I calculate my monthly salary in India if I know my CTC and the split-ups.

How To Do The Reverse Salary Calculation For Ctc Or Net Pay Talentnett

Payment Of Bonus Act Applicability And Calculations

Download Salary Breakup Report Excel Template Exceldatapro Payroll Template Breakup Excel Shortcuts

Car Driver Salary Receipt Template Format Excel Template Receipt Template Project Management Templates Excel Templates

Download Hr To Employee Ratio Calculator Excel Template Exceldatapro In 2021 Excel Templates Excel Calculator

Download Employee Provident Fund Calculator Excel Template Exceldatapro Excel Templates Payroll Template Hire Purchase

Salary Net Salary Gross Salary Cost To Company What Is The Difference

Salary Net Salary Gross Salary Cost To Company What Is The Difference

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

How To Calculate Salary Increase Percentage In Excel Free Template Salary Increase Salary Excel

Customer Service Executive In Mumbai Jobsinmumbai Jobsearch Truejobsindia Job Portal How To Apply Job Search

Salary Calculation Formula In Excel Jobs Ecityworks

Payroll In India 1450k Salary Example 2021 22 Icalcula

Basic Salary Calculation Formula In Excel Download Excel Sheet

What Is A Fixed Monthly Salary Quora

Basic Salary Calculation Formula In Excel Download Excel Sheet

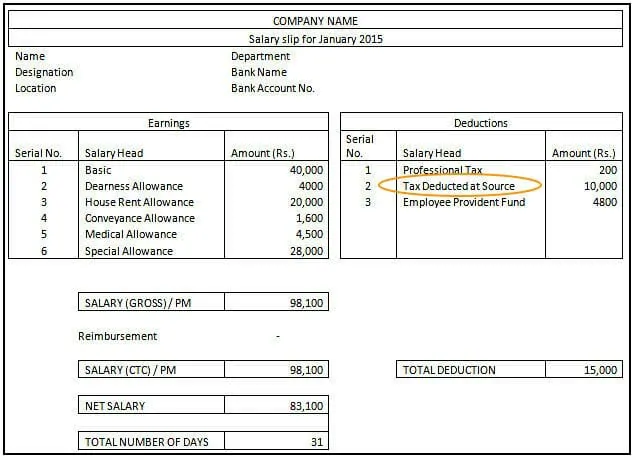

Salary Slips In 2021 How Do They Work Samples Tax Deductions Components Scripbox

What Would Be My In Hand Salary Per Month With Ctc Of 10 Lakhs Quora

Post a Comment for "Monthly Salary Calculator India From Ctc"