Total Debt Vs Annual Income

The unsecured ratio equals your unsecured debt divided by your annual income multiplied by 100 which converts it to a percentage. Lenders look at two ratios when determining the mortgage amount you qualify for which generally indicate how much you can afford.

Create A Website Make A Business Website With Shopify Free Trial Google Ads Ideas Of Selling A Money Management Advice Finance Investing Financial Quotes

Here I will explain Debt to Income Ratio and show you why its important in order to get a Mortgage.

Total debt vs annual income. Household debt increased more rapidly than household income from early in 1993 until the middle of 2007. You can find the total debt of a company by looking at its net debt formula. How to Calculate Total Debt.

The interactive maps contain annual data as of Q4 each year and quarterly data is available for download. Since mid 2007 and the GFC household debt has tended to rise in line with household income. This equals 175 million in total liabilities which is the companys total debt.

For example a detailed total debt formula could be written as. Debt compared with income Income is an important consideration when deciding on a households capacity to make loan repayments in full and on time. We can complicate it further by splitting up each component ie.

Difference Between Total Annual Income Gross Annual Income and Net Annual Income. A high percentage of debt versus income will put you in the high-risk borrower category. The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt load including housing costs is no more than 40 of your gross houshold income.

Multiply that by 52 weeks in a year and your total annual income is 23400. Get You Some Free Sto. Looking into getting a Mortgage.

A companys total debt is the sum of short-term debt long-term debt Long Term Debt Long Term Debt LTD is any amount of outstanding debt a company holds that has a maturity of 12 months or longer. It is classified as a non-current liability on the companys balance sheet. Lenders determine your debt-to-income ratio by dividing your total monthly minimum debt by your total gross income.

Calculate the sum of the companys current long-term and off-balance sheet liabilities to determine its total liabilities. Then subtract the cash portion from the total. To find the net debt add the amount of cash available in bank accounts and any cash equivalents that can be liquidated for cash.

For example if your debt is 1000 per month and your gross monthly income is. Debt-to-Income Ratio We report DTI at the county CBSA and state-levels. In the example calculate the sum of 300000 in total current liabilities 900000 in total long-term liabilities and 550000 in off-balance sheet liabilities.

For example say you carry 8000 on your credit cards 12000 in personal loans and your annual income is 80000. Total Debt Long Term Liabilities or Long Term Debt Current Liabilities. What is Total Debt.

Net debt short-term debt long-term debt - cash cash equivalents Add the companys short and long-term debt together to get the total debt. The time to maturity for LTD can range anywhere from 12 months to 30 years and the types of debt. On the other hand if you see the term.

De très nombreux exemples de phrases traduites contenant total annual income before taxes Dictionnaire français-anglais et moteur de recherche de traductions françaises. Long term liabilities and current liabilities into their sub-components. These ratios are called the Gross Debt.

Debt-to-Income Ratio is the ratio of your income versus your debt level. A high percentage of debt versus income will put you in the high-risk borrower category. Your unsecured debt includes any amounts you owe that arent secured by collateral such as a house or car and it includes credit card debt and personal loans.

De très nombreux exemples de phrases traduites contenant total debt-to-income ratio Dictionnaire français-anglais et moteur de recherche de traductions françaises. When you see the term total annual income it refers to the amount earned within a year or if its at a business during the fiscal year. This rule is based on your debt service ratios.

For each geographic area and time period we calculate DTI as the ratio of aggregate household debt from Equifax excluding student loans to aggregate income. The simplest formula for calculating total debt can be quoted as follows. Income is reported quarterly and aggregated to annual amounts for each geographic region including counties CBSAs and states.

How To Pay Off Debt Student Loan Debt Get Out Of Debt Debt Free Debtsnowball Dave Ramsey Budgeting Finances Budgeting

7 Baby Steps To Financial Peace Dave Ramsey Step 1 1 000 Dollars In An Emergency Fund Step 2 Pa Money Makeover Financial Peace University Smart Money

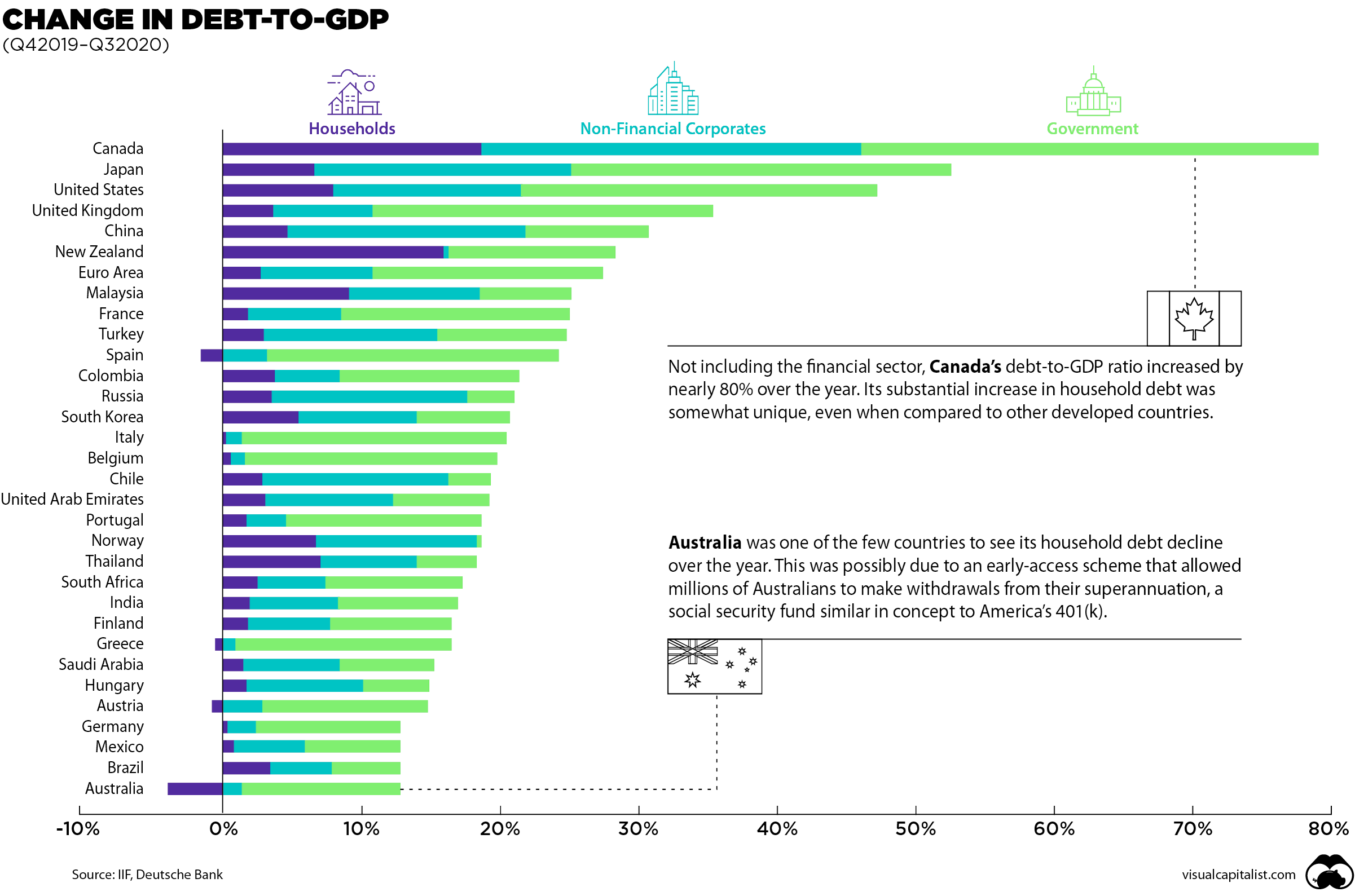

Chart Debt To Gdp Continues To Rise Around The World

So Helpful Glad I Read This Say Goodbye To Debt Budgeting Money Debt Financial Tips

Pin By Creditclarity On Financial Infographics Personal Finance Finance Financial

Pin By Bobettecayeamburyd On Mortgage In 2020 Mortgage Process Home Buying Process Real Estate Tips

2020 Eu Budget For Digital Download Automatic Electronic Etsy Budgeting Budget Spreadsheet Personal Budget

How To Calculate Amortization Amortization Schedule Interest Calculator Amortization Chart

How To Pay Down Debt Snowball And Avalanche Methods Which One Do Your Prefer For Your Person Debt Snowball Calculator Debt Calculator Paying Off Credit Cards

Budgeting Money Makeover Total Money Makeover Money Saving Plan

The Snowball System Is The Best Way To Pay Off Debt Now You Can Keep Track With This Cute Free Prin Debt Snowball Worksheet Paying Off Credit Cards Budgeting

Household Debt Ratio Drops To 158 Of Disposable Income Down From 175 National Globalnews Ca

Chart Debt To Gdp Continues To Rise Around The World

Want To Pay Off Your Debt Here Is How To Use The Debt Snowball Method Infographicsmoney Budgeting Money Budgeting Budgeting Finances

Terms I Understand National Debt Family Income Household Budget

Debt To Income Ratio Calculator Zillow Debt To Income Ratio Debt Income

Debt To Equity D E Ratio Definition Formula

Pin On Understanding Market Capitalization Ev

2020 Budget Template For Brits Uk British Pound Sterling Etsy In 2021 Budget Template Personal Budget Budgeting

Post a Comment for "Total Debt Vs Annual Income"