Total Annual Income Before The Government Withhold Any Taxes

For tax year 2021 the taxable threshold for unearned income for minors is 2200. Any income you earn above 142800 doesnt have Social Security taxes withheld from it.

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

Every employer required to deduct and withhold taxes under MGL.

Total annual income before the government withhold any taxes. 62B 2 that can reasonably expect that total taxes withheld will exceed 1200 but not 25000 for. Answered Sep 19 2019 by cattyboom. How many withholding allowances you claim.

Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate. Residents who are citizens however are subject to tax on investment income and capital gains on their worldwide income. 145 of each of your paychecks is withheld for Medicare taxes and your employer contributes another 145.

For 2015 this wage maximum is 118500. Typically withholding is required to be done by the employer of someone else taking the tax payment. You do not pay tax on things like.

CHAPTER 9 Withholding Estimated Payments Payroll Taxes Income Tax Fundamentals 2013 Student Slides Gerald E. After the end of fiscal year a final tax calculation is carried out when preparing the tax return which takes into account the total annual income and tax advanceswithholding paid during the course of the year. If you withhold at the single rate or at the lower married rate.

As such a couple earning 80000 in 2020 would owe a total tax of 9205. The amount of income you earn. Interest on savings over your savings allowance.

If your combined income was more than 34000 you will pay taxes on up to 85 of your Social Security benefits. Answer the following statement true T or false F accounting-and-taxation 0 Answers. This BIR return is filed by every employer or withholding agentpayor who is either an individual estate trust partnership corporation government agency and instrumentality government-owned and controlled corporation local government unit and other juridical entity required to deduct and withhold taxes on compensation paid to employees and on other income payments subject to Final Withholding Taxes.

Each allowance you. In accordance with the Income Tax Act 2015 Act 896 any investment income and capital gains with Ghanaian source are subject to tax in Ghana in the case of non-residents. Said another way earnings stack upon earnings as the year goes on much like an inverted pyramid.

Only teenagers with significant unearned income will have to pay taxes so you dont need to worry about the IRS coming after you for the 20 your grandma put in your birthday card. The only income taxed at 37 percent would be their earnings over 622050. Depending on the final calculation the individual is obliged either to pay some additional tax the annual tax is higher than tax.

Many translated example sentences containing total annual income before taxes French-English dictionary and search engine for French translations. While there are 52 weeks in a year many employers give employees around 2 weeks paid vacation between the year end holidays and other regularly scheduled. The first 1000 of income from self-employment - this is your trading allowance.

Whether your taxable income is 40000 a year 400000 or 40 million the first 10000 you earn is taxed the same 10. As a rule tax is withheld prepaid monthly as tax advances for personal income tax. The same goes for the next 30000 12.

Withholding Methods ØEmployer calculates income tax withholding from employees paychecks based on their Form W-4 Pay includes salaries bonuses commissions W-4 completed by employee and tells employer. Some governments have written laws that require taxes to be paid before the money can be spent for any other purpose. If you make more than a certain amount youll be on the hook for an extra 09 in Medicare taxes.

Whittenburg Martha Altus-Buller Steven Gill 2013 Cengage Learning. Asked Sep 19 2019 in Business by Aracnato. Interest paid to individuals by a resident financial institution as well as interest earned on bonds issued by the Government.

It will still have Medicare taxes withheld though. This brings the total federal payroll tax withholding to 765 Employers are required to pay an additional equal amount of Medicare taxes and a 62 rate of Social Security taxes. Thank you are you.

This ensures the taxes will be paid first and will be paid on time rather than risk the possibility that the tax-payer might default at the time when tax falls due in arrears. Answered Sep 19 2019 by Sadia. How to Figure Your Withholding Amount.

De très nombreux exemples de phrases traduites contenant total annual income before taxes Dictionnaire français-anglais et moteur de recherche de traductions françaises. Companies are required by law to withhold federal and state income taxes from employees paychecks and remit these taxes to the government. Income from a trust.

Wages paid above a fixed amount each year by any one employee are not subject to Social Security tax. Medicare tax of 145 is withheld from wages with no maximum. For the 2019 and 2020 tax years single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits.

There is no income limit on Medicare taxes.

Payroll Tax What It Is How To Calculate It Bench Accounting

Pin By Paul Lionetti On Quick Saves In 2021 Tax Forms Internal Revenue Service W2 Forms

Publication 505 2015 Tax Withholding And Estimated Tax Internal Revenue Service Information Design Tax

Back Tax Help Johnson City Tn 37601 M M Financial Blog Tax Help Back Taxes Help Tax Debt

Understanding Your Pay Statement Office Of Human Resources

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractors Or That Have Sales In 2021 Bookkeeping Business Business Tax Small Business Tax

How To Fill Form W2 Tax Forms Accounting Services W2 Forms

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Understanding Your W 2 Controller S Office

Tax Withholding For Pensions And Social Security Sensible Money

What Is Irs Form 1040 In 2021 Income Tax Return Tax Return Filing Taxes

Paycheck Taxes Federal State Local Withholding H R Block

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

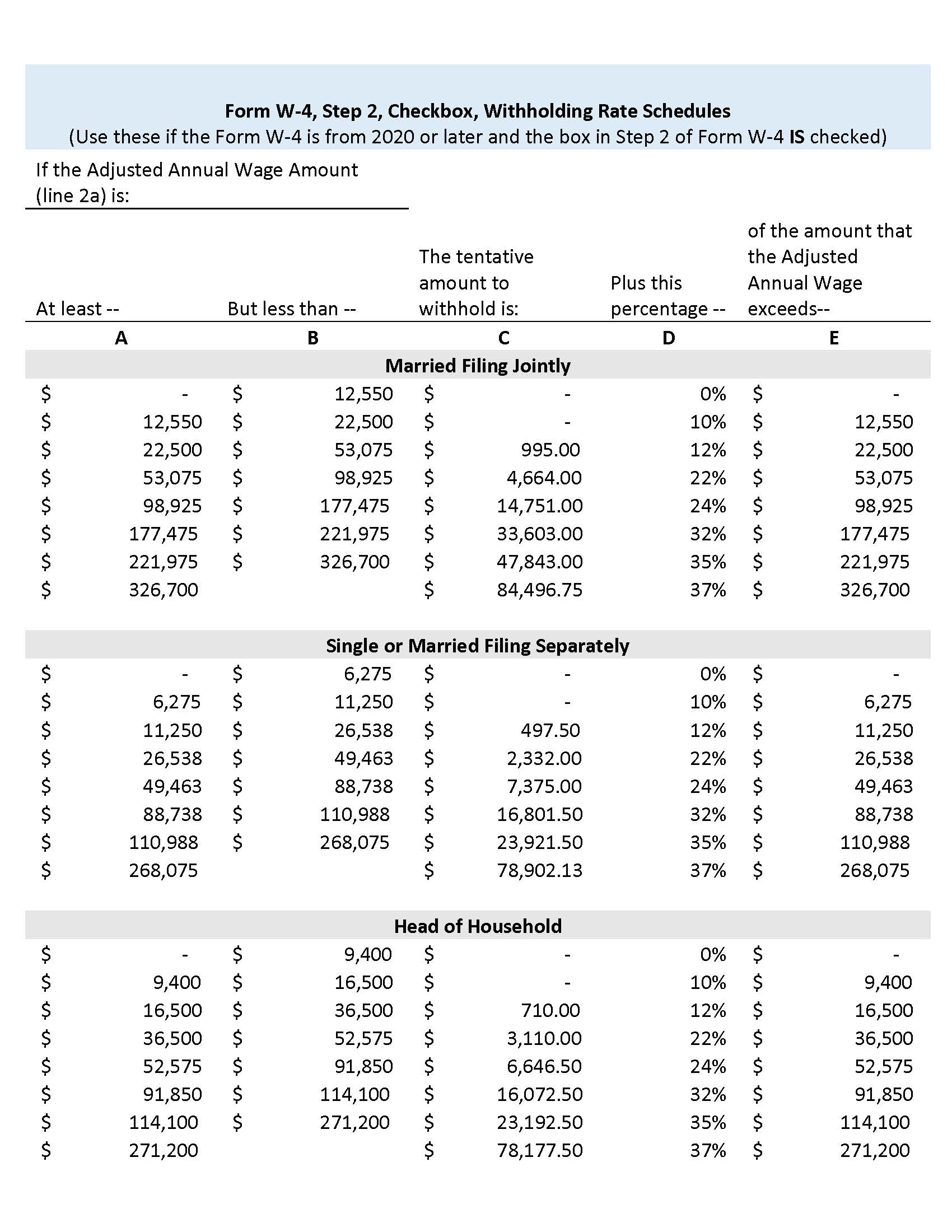

W 4 Form How To Fill It Out In 2021

How To Fill Out The W 4 Tax Withholding Form For 2021

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "Total Annual Income Before The Government Withhold Any Taxes"